Turbo Charge Your Savings Plan

/As I’ve previously written, investing in turbulent markets is much like Driving on Ice. The feeling of loss of control is scary, and our brains don’t like that feeling. Therefore, it prompts us to remove that feeling through action. Unfortunately, just like when our car is sliding on ice, our initial financial reactions are often the wrong ones.

One such example is the desire to suspend contributions to retirement savings during down markets. The logic is simple; investors have seen their invested capital fall in value so they are hesitant to add more capital that may also fall in value. It forgets, however, that the price of the investments that your savings plan requires you to accumulate over time have fallen along with your account value. That means that you’re able to purchase more shares per dollar of contribution during periods of down markets.

The net effect is that by continuing to make your planned contributions you accumulate extra shares. Those extra shares not only mean better long term performance, but it also allows you to get back to break even faster once markets begin to recover.

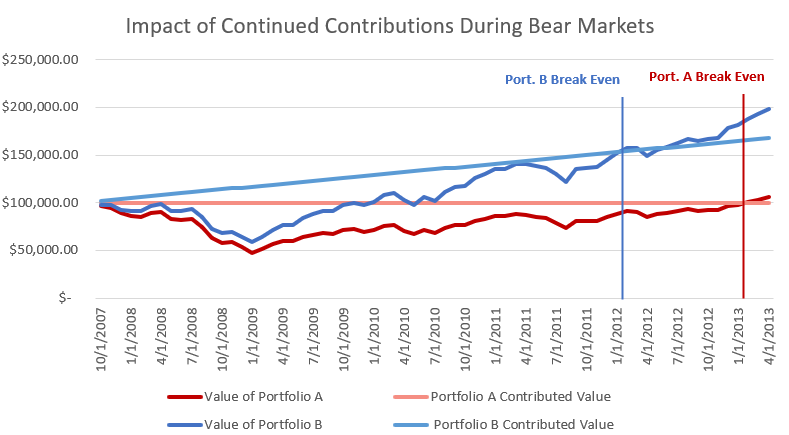

Let’s look at an example using the Great Recession S&P 500 Bear Market of 2007 through 2013:

Source: Yahoo Finance. Portfolio values based on S&P 500 closing price on the first of each month from 10/1/2007 through 5/1/2013. Portfolio A represents 647 shares, or an initial investment on 10/1/2007 of $100,000. Portfolio B represents 647 shares on 10/1/2007, an initial investment of $100,000, and $1,000 contributions at the index closing price on the 1st of each month beginning 10/1/2007. Illustration does not include dividends. Past performance does not guarantee or indicate future results. Index performance is for illustrative purposes only. You cannot invest directly in the index.

In this scenario, we’re assuming that two investors each had $100,000 invested in the S&P 500, an admittedly non-diversified portfolio but one that easily illustrates the point. Portfolio A, represented by the red lines, shows a portfolio invested entirely in the S&P 500 with suspended contributions. The pale Red line is the invested principal, which doesn’t change because no new contributions are being made, while the dark red line is the portfolio value. Portfolio B, represented by the blue lines, shows the portfolio where the investor continued making monthly contributions. As with the red lines, the light blue line represents the invested principal. In this case it rises steadily over time because of the recurring contributions. The dark blue line represents the actual fair market value of the initial holdings plus the value of all invested contributions.

As you can see, the investor who stayed true to their savings plan and maintained their contributions, portfolio B, saw their portfolio value surpass their invested principal a full year faster than that of the investor that suspended their savings plan, portfolio A. Further, the fair market value of portfolio B ended the example period roughly $30,600 larger than the invested principal, while portfolio A ended with roughly $5,700 more than the invested principal. Faster break-even, better long-term return.

While the desire to take action to make ourselves feel better during down markets is understandable, the common method for doing so, stopping contributions, often ends up preventing us from recouping losses more quickly. While it may seem counter-intuitive, sticking to your savings plan, or increasing it, can help provide the desired results.